- RATING

- Sustainability Alignment Rating

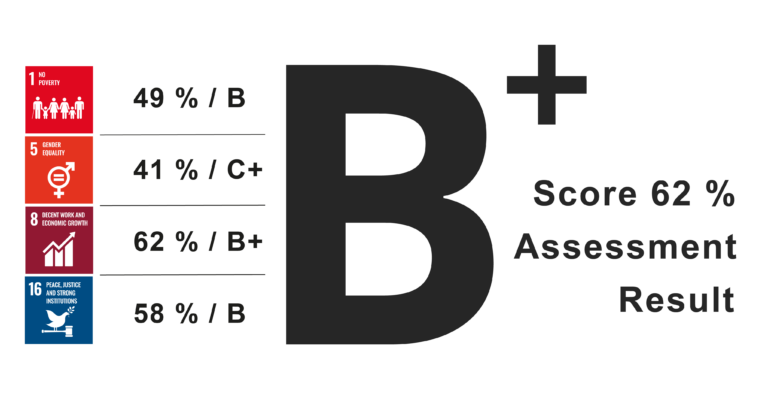

We assess circa 60 indicators with more than 120 (sub-) questions selected specifically for the microfinance industry and assign them to the respective SDG target.

They cover qualitative information and quantitative data at institutional & portfolio levels to identify positive contributions & potential adverse impacts to the SDGs.

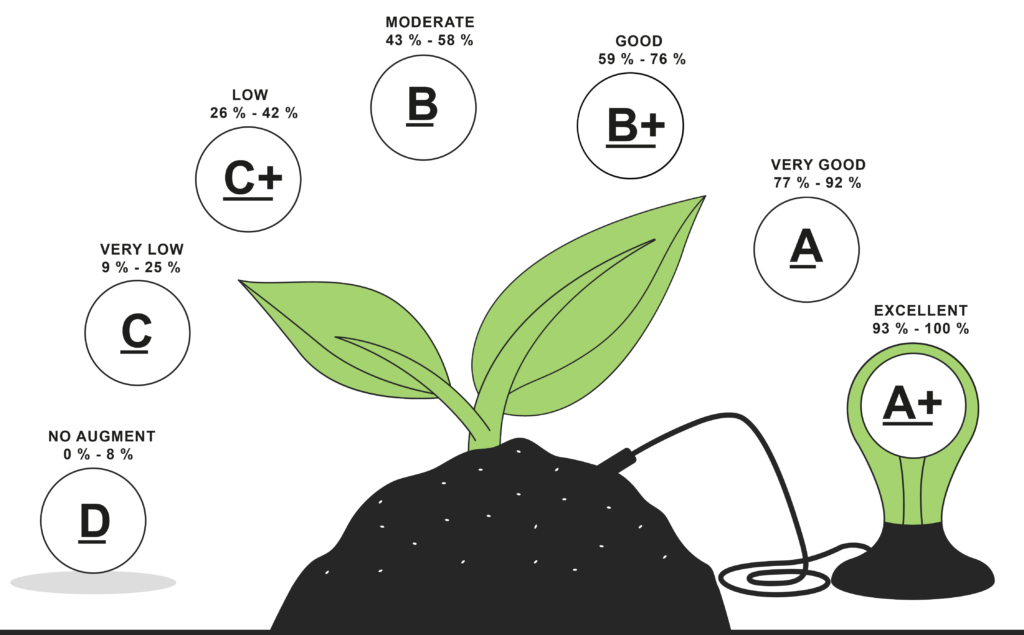

A stronger SDG alignment (the higher the score in %) is more likely to indicate a higher sustainability performance and therefore an impact-generating potential.

- Our process

DATA COLLECTION QUESTIONNAIRE

Prior to formal engagement, we prioritize understanding your personal situation, financial goals, and key concerns that drive your search for financial advice. This forms the basis for a mutually agreed-upon scope of work. Please find below a comprehensive list of our capabilities.

DATA ANALYSIS & VALIDATION

Our comprehensive planning engagements start by jointly assessing your balance sheet and cash flow. Access our secure client portal to upload documents or link your accounts electronically.

DOCUMENT VERIFICATION

We collaborate with you to prioritize your goals and assess the financial choices and risks involved in achieving them. Through close partnership, we establish a baseline projection of your future financial wealth, providing a roadmap for your success.

AFISAR© INTERVIEW

We use our financial model to develop alternative scenarios, informing recommendations on taxes, insurance, and investments to align with your goals. Exploring scenarios to align recommendations.

RATING COMMITEE

We use our financial model to develop alternative scenarios, informing recommendations on taxes, insurance, and investments to align with your goals. Exploring scenarios to align recommendations.

AFISAR© REPORT

We use our financial model to develop alternative scenarios, informing recommendations on taxes, insurance, and investments to align with your goals. Exploring scenarios to align recommendations.

EXECUTIVE MANAGEMENT WORKSHOP

We use our financial model to develop alternative scenarios, informing recommendations on taxes, insurance, and investments to align with your goals. Exploring scenarios to align recommendations.

- Insights / Rating